where does credit score start canada

Similarities Between American vs. Your credit score comes from the information in your credit report.

Why It Takes 7 Years To Establish Good Credit Moneyunder30

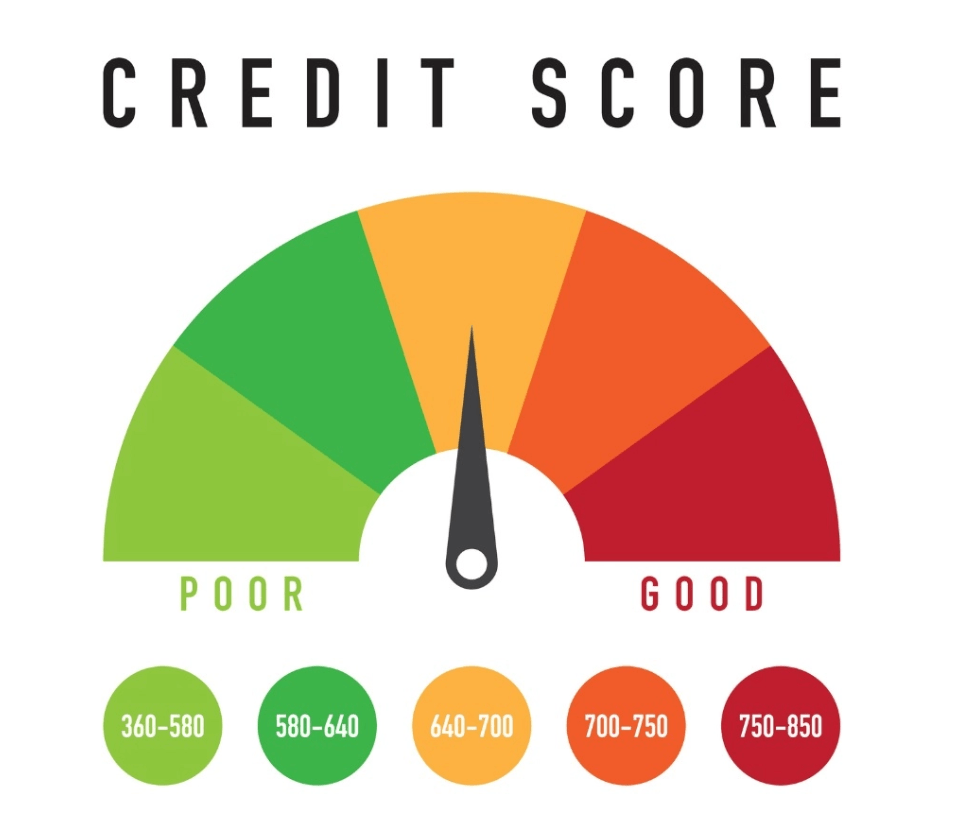

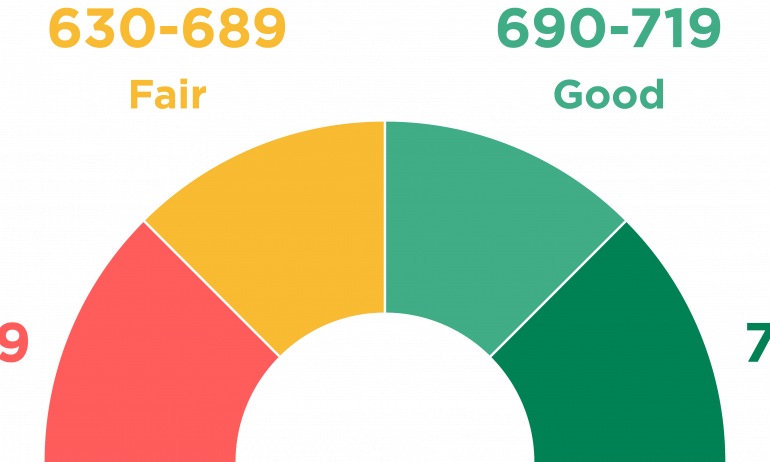

However there are ranges that tell lenders if you are Poor Fair Good Very Good or Exceptional with credit.

. In Canada your credit score refers to a three-digit number usually between 300 and 900 that indicates your creditworthiness In other words its a. Where does my score come from. In Canada credit scores can be as high as 900 and as low as 300 but dont worry.

Learn more about how your credit score is calculated. According to Canadas Office of Consumer Affairs Canadians use a scale between 300 and 900 based on reporting from two credit bureaus. But your credit history from a previous country doesnt transfer over so youll need to build.

The answer may surprise you. Do you begin at a the highest possible credit score b the lowest or c somewhere in between. In Canada you will get credit scores as high as 900 points as a simple starting point.

Who creates your credit report and credit score There are two main credit bureaus in. Your credit score an all-important number ranging from 300 to 900 tells lenders in Canada how trustworthy you are and whether you deserve a good deal on a mortgage. ViDI Studio Shutterstock Most Canadians begin their credit history with their very first credit card which they can get on their own by the.

In Canada credit scores range between 300 and 900 with a higher score being better. In TransUnions view a score that is above 650 will likely allow you to receive a. On average Canadians within the youngest age bracket 18 25 have a credit score of 692 while the oldest 65 have a credit score of a little over 740.

3 hours agoIf you want to borrow money or buy a home in Canada youll need a credit score. Your score is below average and lenders will see you as a risky. In reality everyone starts.

Its d none of the above. These companies collect data about. Equifax and TransUnion are the two main credit bureaus in Canada.

However American Express credit cards have a small quirk. There are two main credit bureaus in Canada Equifax and TransUnion. Credit scores start at 300.

Both Equifax and TransUnion will send you your latest. If youve never had credit activity a credit card or loan or instance you wont start. Thats because your credit score from your home countrygood or badwont carry over to Canada.

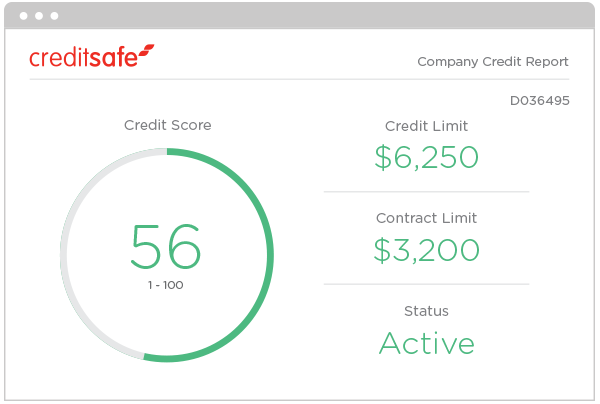

Check their websites to see if you will be charged a fee for. Canadian Credit Reports In Canada there are two main credit bureaus that can create a credit report in your name when you start using. They use this information.

These private companies only collect information about how you use credit. Poor 580 or less. You can get your free credit report from either of the two major credit bureaus in Canada Equifax and TransUnion.

5000 Total Credit Card Balances 10000 Total Credit Card. Credit scores have little to no impact on the immigration process. The first step in establishing and building credit is understanding what comprises your credit score.

This is because a lender may give more weight to certain information when calculating your credit score. Their job is to. According to TransUnion credit score ranges are categorized as follows.

You can request your credit score directly from any of the major credit bureaus Equifax Experian and TransUnion. In Canada there are two main credit bureaus Equifax and TransUnion that are responsible for calculating individuals credit scores. It shows how risky it would be for a lender to lend you money.

If youre interested in the math heres a look at the equation you can use to calculate credit utilization. Most Canadian credit cards provide a 21-day interest-free grace period which is the minimum requirement by law.

The Ultimate Guide To Credit Scores In Canada

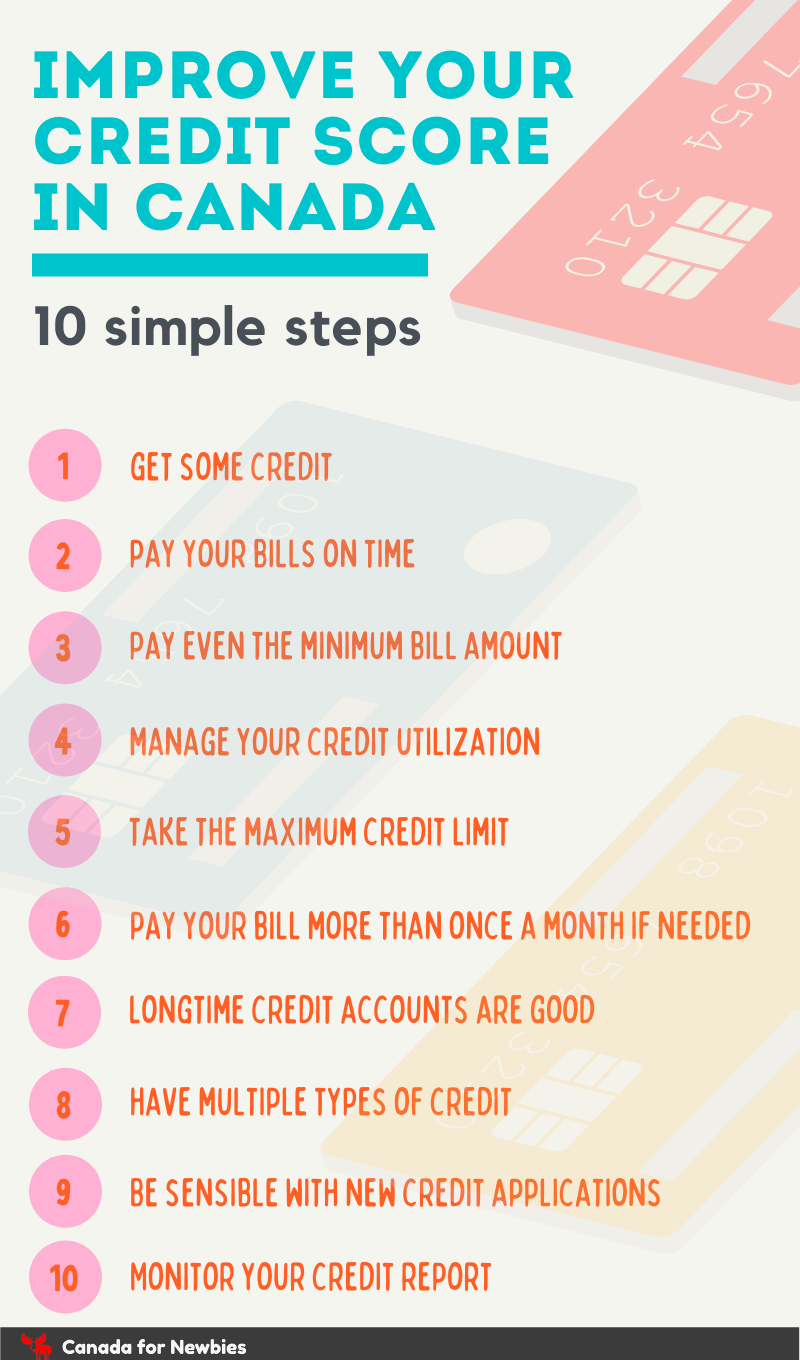

How To Improve Your Credit Score 10 Step Guide Canada For Newbies

600 Credit Score Is It Good Or Bad Experian

What Is A Good Credit Score In Canada

Credit Score In Canada What These 3 Digits Say About You Creditcardgenius

How To Improve Your Credit Score Lendingtree

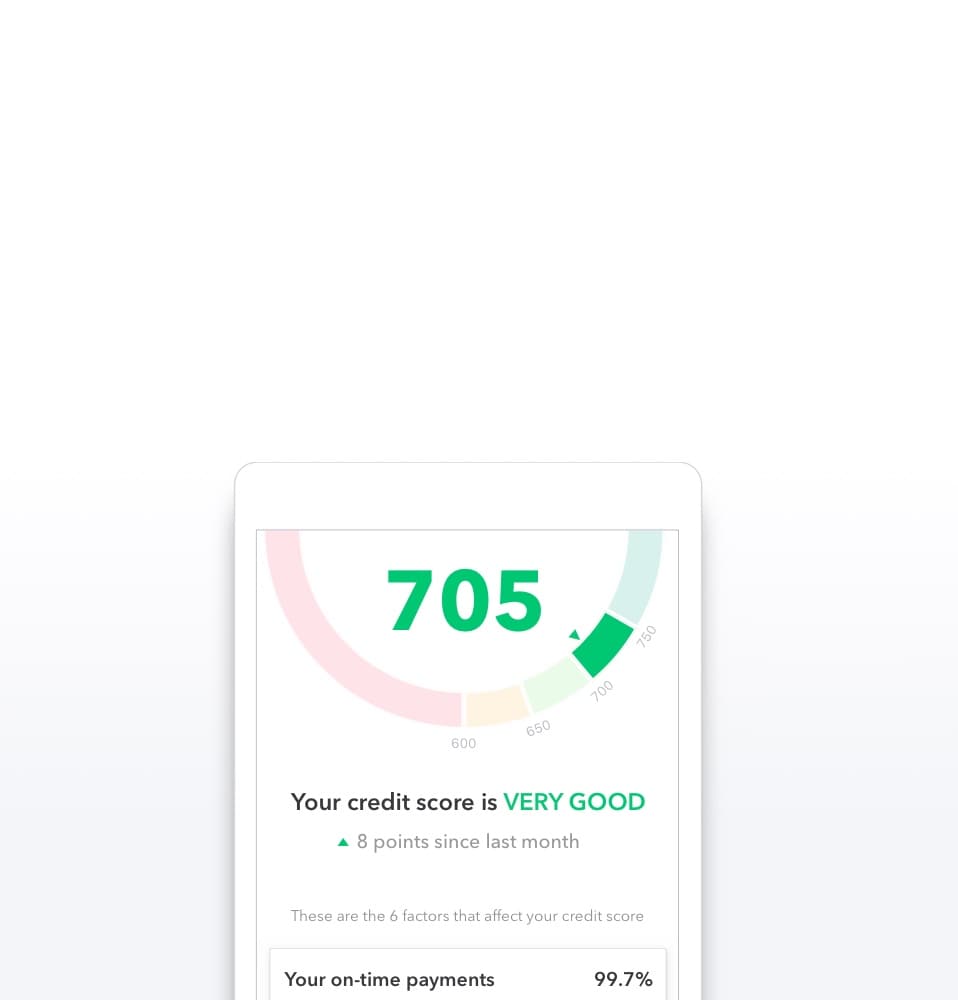

Free Credit Score Free Credit Report With No Credit Card Mint

How To Improve Your Credit Score In Canada What You Need To Know

Credit Score Ranges Bankruptcy Attorneys O Bryan Law Offices

What Credit Score Do You Need To Get A Car Loan

What Is A Good Credit Score Forbes Advisor

:max_bytes(150000):strip_icc()/credit-score-factors-4230170-v22-897d0814646e4fc188473be527ea7b8a.png)

The 5 Biggest Factors That Affect Your Credit

What Is A Good Credit Score Nerdwallet

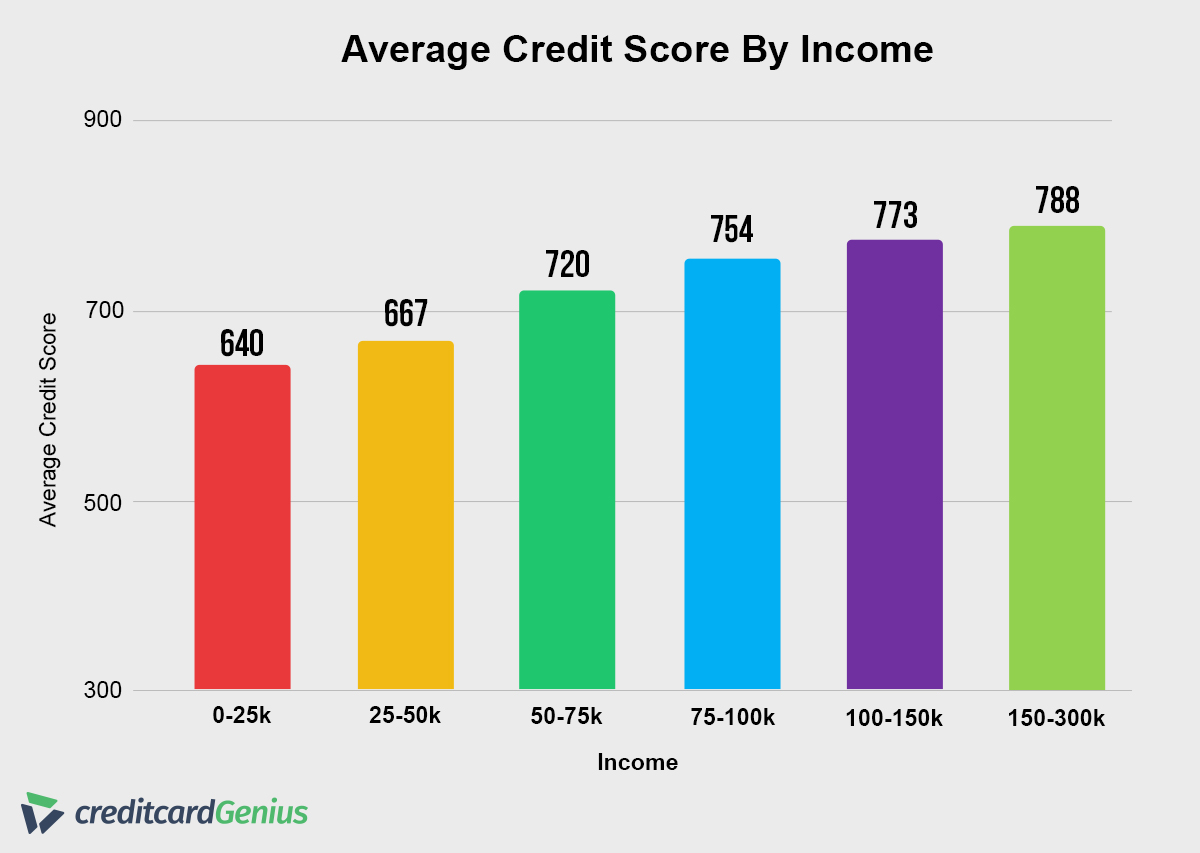

What Is The Average Credit Score In Canada And How Do You Compare

What Is A Good Credit Score Nerdwallet

9 Best Loans Credit Cards 500 To 550 Credit Score 2022

Credit Check Companies With A Free Business Credit Report Creditsafe

How To Improve Your Credit Score 10 Step Guide Canada For Newbies